Mountain Valley Pipeline has not completed the permitting process

There are many moving parts to this story. Here is what we can tell about the current status:

No trees have been cut to date in Virginia, though cutting has started in West Virginia. MVP would need to cease cutting by March 31 due to the presence of endangered bats in trees along the routes, and they will be unable to resume until October.

MVP still needs permits from the US Forest Service, historic preservation office in in Virginia, and the Virginia Department of Environmental Quality. Numerous court cases are pending, including one brought by landowners that is being in heard in Roanoke. EQT, the Pittsburgh fracking company that is the primary owner, operator and customer of the pipeline, is splitting into two companies at the behest of hedge fund managers who are keeping the company afloat; fracking loses money, while owning a federally-subsidized pipeline makes money.

Details:

The Federal Energy Regulatory Commission (FERC) is giving authority to go ahead for much of the route, and timber cutting has occurred in West Virginia but not Virginia. Even with FERC approvals, all conditions have not been met. FOR EXAMPLE:

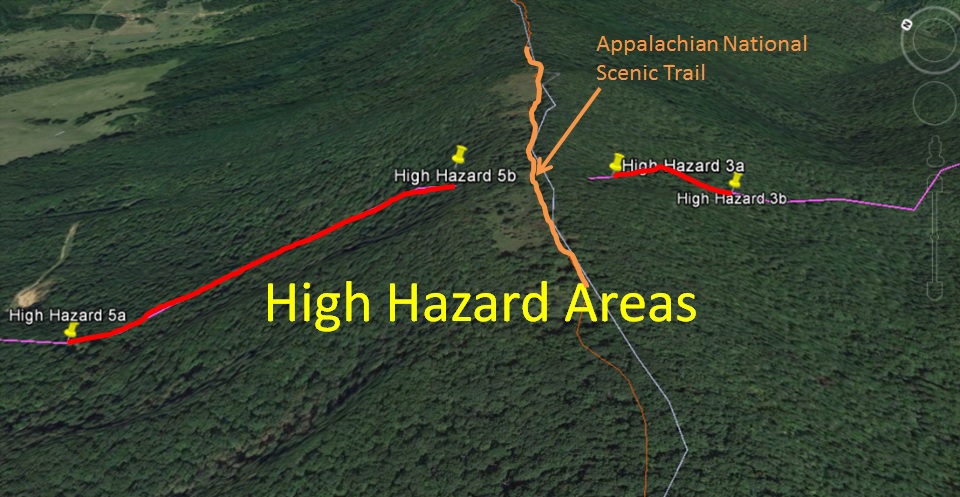

MVP needs a timber permit from the US Forest Service for the 3.5 miles in Jefferson National Forest and a notice to proceed in the National Forest from FERC. We believe this will happen soon. The National Forest may be the first place in Virginia where trees are cut – very disappointing, since many counted on the FS to help protect the Appalachian Trail and water quality to downstream communities. Erosion and sedimentation from streams originating in these uplands will affect areas as far away as Smith Mountain Lake, according to a study completed for the Forest Service by MVP’s own consulting firm.

MVP needs to complete Section 106 requirements for Cultural and Historic Districts. Although MVP keeps saying they have complied, county governments and local citizens keep responding that they have not. For example, only today Roanoke County made such a filing on behalf of 3 districts on Poor Mountain and Bent Mountain. You can see it by downloading the first highlighted pdf file here: https://elibrary.ferc.gov/idmws/file_list.asp?accession_num=20180223-5002

And the lawyer for the Newport Historic District similarly disputed MVP’s claims, as did the Giles County government and numerous landowners in Newport.

*Landowners along the route brought a case forward against FERC and MVP in the Western Federal District Court (Roanoke). As of February 21, 2018, MVP has posted a $500,000 bond and received permission to enter property for surveys if they give 72 hours notice. When they sued over 300 landowners, MVP asked permission to begin surveying and using property before any price had been agreed upon for use of the property. Judge Dillon told MVP they would have to complete appraisals of all properties and post a bond for 3x that amount before they could enter properties. MVP did hasty appraisals and initially got a go-ahead from Judge Dillon to begin doing surveys on these properties. However, after legal counsel for the landowners made a filing showing that MVP did not follow federal law in the way that it performed the appraisals, Judge Dillon issued an order holding this permission in abeyance pending clarification of certain points. She has since backed off on the need for legal appraisals and accepted the $500,00 bond as noted above. The company’s assertion that they would lose money apparently was more important than the landowner rights to private property, even for a product that is likely intended for overseas export or use far from Virginia.

There are several other court cases in progress against FERC, MVP, the Virginia DEQ and the US Forest Service. These have been brought by landowner and environmental groups. In addition, local county and city governments continue to make filings to FERC through their lawyers about disagreements with actions by FERC.

Virginia’s Department of Environmental Quality (DEQ) has not yet approved the final Erosion and Sedimentation plans for MVP. So far, the state has essentially relinquished its authority to protect our water by creating a bizarre, fragmented and secretive process for reviewing water quality impacts of the pipeline (all of this occurred on Gov. Terry McAuliffe’s watch). THIS COULD STILL CHANGE – the state still has legal authority. Although both New York State and Connecticut have successfully stopped such pipeline using the state’s delegated authority under the Clean Water Act, McAuliffe claimed that the state had no power to stop either the Atlantic Coast or the Mountain Valley Pipeline. The Water Authority Board issued a permit for MVP after a perfunctory hearing in December. I attended, and it was quite clear that the appointed members had little sense of what they were doing. 3 of the board members seemed opposed to the permit, but that had no impact on the result. One of the most important parts of the process – which no one was permitted to comment on during the hearings – was erosion and sedimentation – the biggest impact of the whole project. DEQ has conducted a secretive study of these impacts and still has not approved final plans. The draft plans that were made available to the public allowed entirely inadequate control measures and would likely send of thousands of tons of new sediment downriver throughout the life the project, saddling downstream communities with additional storm water fees in perpetuity. Both the City of Roanoke and the City of Salem passed unanimous resolutions questioning this burden being imposed on local taxpayers by DEQ.

* Mitigation for damage to water quality. The City of Roanoke alone estimates over $30 million annually in increased storm water fees due to this project. However, in December the McAuliffe administration settled for $7.5 million TOTAL for the whole state for the life of the project to repair damage done to water quality by MVP. This essentially pays for a bit of monitoring so that we can total up the damage. Taxpayers will bear the actual burden of the damage.

* Mitigation for forest fragmentation. The state’s DCR staff did a good job of showing that damage to forests would be 4x as high as MVP estimated, and the state has received over $27 million to do mitigation projects. This does not stop the project or do a thing about catastrophic damage, but it is certainly something.

[You can see Virginia’s mitigation settlement for both water and forests here: 370748346-MVP-Comprehensive-Resource-Impacts-Agreement. A critical analysis can be found here.]

* As Laurence Hammack revealed in a well-researched front page story for the Roanoke Times, the company chosen by MVP to do pipeline construction in Virginia, Precision Pipeline, has a dismal environmental record. In addition, Precision seems to have a surprising number of fatalities on its project – see this table, PrecisionXOSHAXfatalities.injuries, which I compiled from OSHA reports. We do not yet have data to compare this to other pipeline companies but have had disturbing information about the company’s safety reputation within the industry. It should also be noted that Precision was a builder of the Dakota Access Pipeline and Precision is engaged in a lawsuit to criminalize protests against their work. These are the people being invited – literally – into our back yards.

* EQT, the Pittsburgh fracking company that would supply the natural gas, operate the pipeline and own over 60% of the product for sale overseas is splitting into two parts after years of pestering from the hedge fund managers who keep them financially afloat. The hedge fund managers want no part of the fracking business, which has been losing huge sums of money ($500 million net loss in 2016) for years. They want the pipeline, which allows a federally subsidized profit of 14%. And they shall have it. A study done for Appalachian Mountain Advocates in 2016 warned that the ownership of this company was unstable and that they would not make a good partner for local communities.

SUMMARY OF THE STUDY REGARDING RISKS OF EQT/MVP AS A PARTNER:

OWNERS, BUYERS AND RISKS OF MVP:

- The high rates of return (up to 14%) make it attractive for upstream producers like EQT to invest in a guaranteed return rather than the volatile natural gas market. “EQT, for example, has taken advantage of investors’ willingness to fund pipeline development by creating an EQT-controlled master limited partnership (EQT Midstream), which has been able to raise equity through public offerings both for new pipeline projects and for buying gathering and processing infrastructure formerly owned by EQT, leaving EQT in a much better cash position than many other drillers. Such short-term balance sheet considerations for a company like EQT do not translate into rational planning of long-term infrastructure.” (p. 6)

- Owners: The pipeline is owned by EQT Midstream (45.5% ownership interest), NextEra Energy (31%), Con Edison (12.5%), WGL Holdings (7%), Vega Energy Partners (3%) [WGL since bought an additional 3%; they have contracts to ship natural gas to India] and RGC Resources (1%) and would be operated by a subsidiary of EQT.

- Customers: All of the capacity on the Mountain Valley Pipeline has been reserved by producer or shippers of natural gas. The companies that have entered into shipper contracts are EQT (64.5%), Consolidated Edison (12.5%), USG Properties Marcellus Holdings, a subsidiary of NextEra (12.5%), WGL Midstream (10%) and Roanoke Gas (0.5%). EQT and USG Properties Marcellus Holdings, which together have contracted for 77% of the capacity of the pipeline, are natural gas supply companies.

- Risks for investors: Investors in the Mountain Valley Pipeline are at greater risk of being harmed by financial problems with the shippers than investors in the Atlantic Coast Pipeline are because natural gas producers are much less financially stable than regulated utilities. According to Moody’s Investor Services, the long-term credit rating of EQT is Baa3 (the lowest investment-grade credit rating). EQT has had negative free cash flow for the past nine years, meaning that the cash generated from drilling operations is not sufficient to finance the ongoing capital expenditures of the company. EQT’s situation appears to be worsening, with free cash flow declining from -$450 million in 2013 to -$1,217 million in 2015.

- Risks to communities: EQT does not appear to be a stable, long-term partner for these communities. Its weakened financial position suggests it will adopt only a limited commitment to communities or perhaps be forced to sell its ownership interests to a new company that is not part of current deliberations. In addition, pipeline safety problems are on the rise, as documented in Figure 5, and how a company perceives such risk, monitors for it, seeks to prevent it, and communicates about it to affected communities is paramount.